Skatteetaten – Your tax conditions

Tax refund or surcharge? Summary of your tax return in one place!

Wondering how much your tax refund or surcharge will be? You'll find it at the bottom of your tax return all information in one place!

Summary of tax terms:

- Total the amount of tax

- Amount tax refund

- Surcharge amount

- Detailed information on individual items

No summary?

If you don't see the summary, there may be some information missing from your return. Complete them and the summary will be updated automatically.

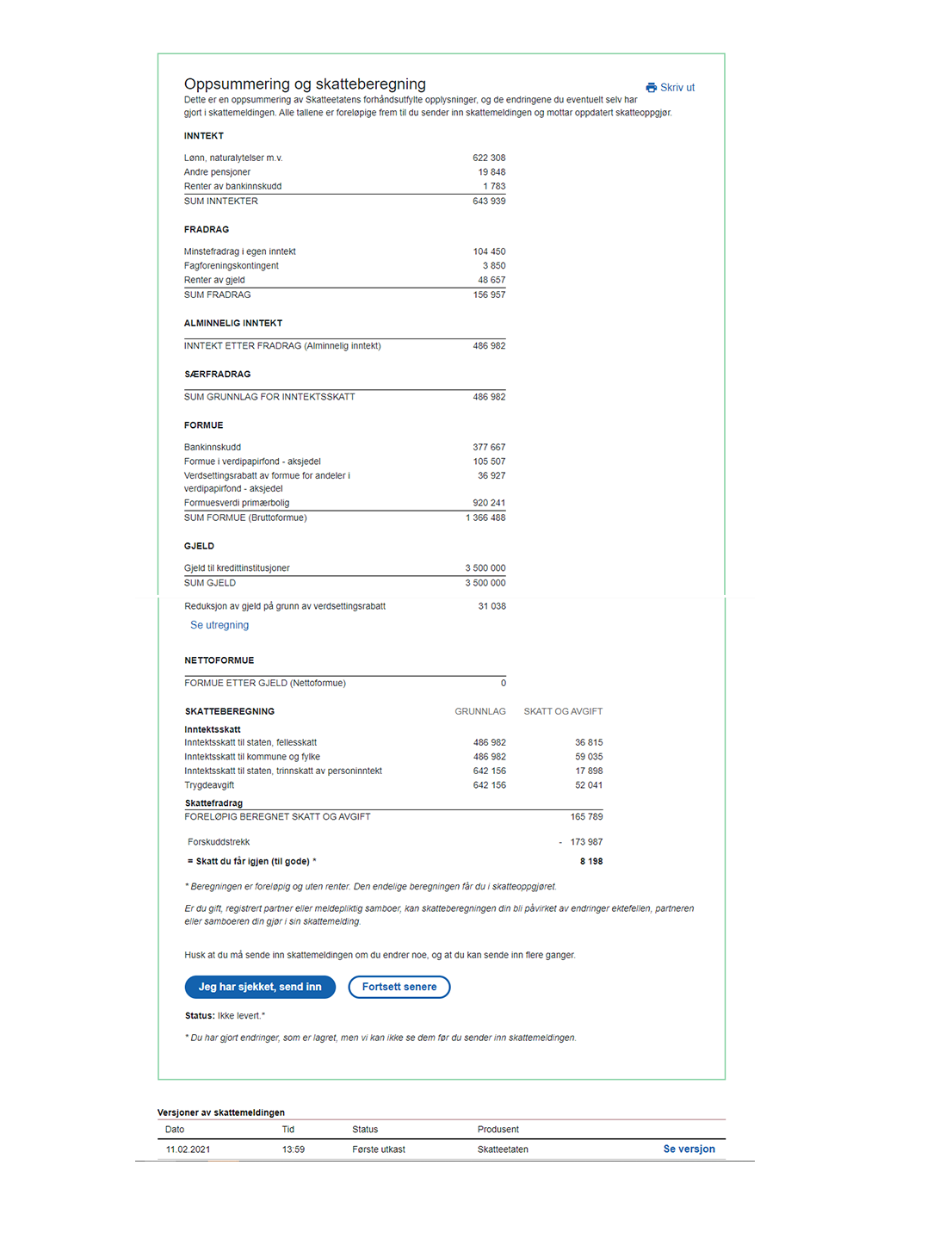

Tax summary example:

See an example of what a tax return summary might look like.

Description of a sample tax return (based on the image above):

Summary and tax calculation:

- Income:

- Gross salary: NOK 622

- Other pensions: NOK 19

- Interest on bank deposits: NOK 1783

- Total income: 643 939 NOK

- Discounts:

- Tax relief: NOK 104

- Union dues: NOK 3850

- Interest on debt: NOK 48

- Total discounts: 156 957 NOK

- Income after deductions: 486 982 NOK

- Income tax:

- State income tax: NOK 36

- Income tax up to commune and district: NOK 59

- State income tax (third threshold): NOK 17

- Social security contribution: NOK 52

- Total taxes and contributions: 165 769 NOK

- Tax refund: 8 198 NOK

Additional information:

- Form: T-36

- Status: Not sent

- Order date: 11.02.2021 13:59

- Version: First study

Comments:

- The above data is exemplary and may vary depending on the taxpayer's individual situation.

- W tax return there may be other items, e.g. business income, child allowances, etc.

- Please check all of them carefully information in your tax return before sending it.

Description of individual items in the image:

1. Tax summary and calculation:

This section contains information about income, allowances, income tax and social security contributions. At the bottom of the section you will see the amount of the tax refund or surcharge.

2. Income:

This section contains information about all the taxpayer's income, e.g. gross salary, pensions, interest on bank deposits, etc.

3. Discounts:

This section contains information about all the reliefs to which the taxpayer is entitled, e.g. tax relief, union dues, interest on debt, etc.

4. Income after deductions:

This is the amount of the taxpayer's income after deducting all tax reliefs.

5. Income tax:

This section contains information about tax amount income that the taxpayer must pay. Income tax is divided into several parts: state income tax, commune and district income tax and income tax (third threshold).

6. Social security contribution:

This is a mandatory contribution that every taxpayer must pay.

7. Tax refund:

This is the amount of money that the taxpayer will receive back from the tax office.

8. Additional information:

This section provides information about the tax return form, its status, date and version.

9. Notes:

This section contains important notes about your tax return.

10. Taxpayer's signature:

The taxpayer must sign tax return before sending it.

Skatteetaten – Your tax conditions

Exemplary obraz presents a tax return for an individual in Norway. The declaration contains information on income, tax reliefs, income tax and social security contributions. The amount of the tax refund or surcharge is shown at the bottom of the return.

Please note that the above data are examples and may vary depending on the taxpayer's individual situation.

Read our next article: 250 in Viken invited to participate in a public health survey

If you are interested in this article, please rate it. This way you assess the level of interest.

Image source: skatteetaten.no